Article

Jan 8, 2026

Banking, Investing & Taxation for NRIs (2026)

The Complete Guide to NRE, NRO, FCNR, PIS vs Non-PIS, and SOA Mode (2026)

For NRIs, financial outcomes in India depend less on product selection and more on correct banking structure, regulatory compliance, and tax treatment.

Misunderstanding NRE, NRO, FCNR, or PIS rules often leads to excess tax, blocked repatriation, and operational friction.

This all-in-one guide covers:

NRE vs NRO vs FCNR accounts

Uses and taxation of each

Repatriation rules

PIS vs Non-PIS investing

SOA mode for mutual funds

A clear banking + investing decision flow

SEO-optimized FAQs

Who This Guide Is For

This guide applies if you:

Are an NRI or OCI

Earn income outside India

Maintain bank accounts in India

Invest or plan to invest in Indian assets

Want compliant, tax-efficient structures

NRE, NRO, and FCNR Accounts Explained

1. NRE Account (Non-Resident External)

Purpose

To park foreign income remitted to India.

Key Characteristics

Maintained in INR

Funded only by foreign income

Fully repatriable (principal and interest)

Taxation

Interest is fully tax-free in India

No TDS applies

Best Used For

Investing in Indian mutual funds and equities

Long-term wealth building in India

Easy repatriation of funds

2. NRO Account (Non-Resident Ordinary)

Purpose

To manage income earned in India.

Examples

Rental income

Pension

Dividends

Sale proceeds of Indian assets

Key Characteristics

Maintained in INR

Used only for India-sourced income

Taxation

Interest is taxable in India

TDS typically at 30% + surcharge + cess

Repatriation

Limited to USD 1 million per financial year

Requires Form 15CA and Form 15CB

3. FCNR Account (Foreign Currency Non-Resident)

Purpose

To hold foreign income in foreign currency without INR conversion.

Key Characteristics

Maintained as fixed deposits only

Denominated in USD, GBP, EUR, etc.

No exchange-rate risk

Fully repatriable

Taxation

Interest is tax-free in India

No TDS applies

Best Used For

Hedging against INR depreciation

Parking surplus foreign income

Short- to medium-term capital protection

Comparison: NRE vs NRO vs FCNR

Feature | NRE | NRO | FCNR |

Currency | INR | INR | Foreign |

Source of funds | Foreign income | India income | Foreign income |

Interest tax | Tax-free | Taxable | Tax-free |

TDS | No | Yes | No |

Repatriation | Fully allowed | USD 1M/year | Fully allowed |

FX risk | Yes | Yes | No |

Step 1: Banking Foundation for Investing

Use NRE for investments wherever possible

Use NRO strictly for India-sourced income

Use FCNR to manage currency risk on foreign income

Correct segregation simplifies taxation and repatriation.

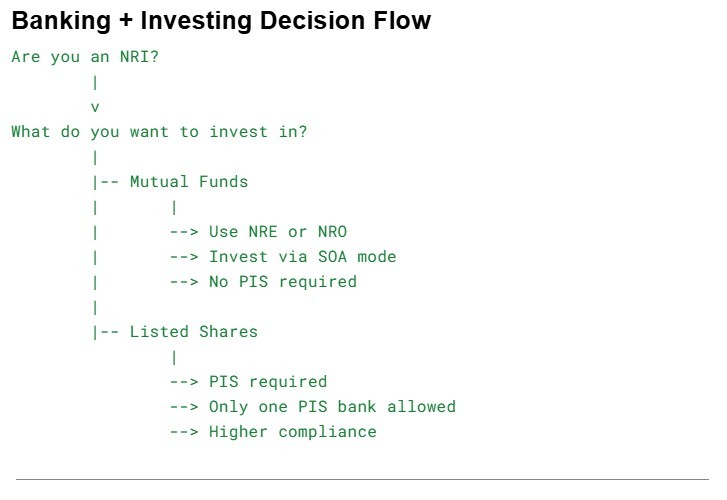

Step 2: What Are You Investing In?

NRIs typically invest in:

Indian mutual funds

Indian listed shares (direct equity)

The regulatory treatment for these two asset classes differs materially.

PIS vs Non-PIS Investing

What Is PIS?

PIS (Portfolio Investment Scheme) is an RBI-regulated mechanism that allows NRIs to invest in Indian listed shares directly.

Under PIS:

Every trade is reported to RBI

Investment limits are monitored by a designated bank

Demat, trading, and bank accounts are tightly linked

PIS applies only to direct equity shares.

It does not apply to mutual funds.

How Many PIS Accounts Can an NRI Have?

An NRI is permitted to maintain only one active PIS account at any given time across all banks.

Implications:

All PIS trades must route through one designated bank

Multiple PIS accounts are not permitted

Changing banks requires closure of the existing PIS approval

This restriction is a key source of operational complexity.

Why the PIS Process Is Complex

Common challenges include:

Dependence on a single bank

Restricted broker choice

Trade settlement delays

Reconciliation issues

RBI investment cap monitoring

Corporate action mismatches

Difficulty switching banks

Additional bank charges

Non-PIS Investing Explained

Non-PIS investing refers to NRI investments that fall outside the PIS framework.

Key points:

Mutual funds do not require PIS

No RBI trade reporting

Lower operational dependency on banks

SOA Mode: Investing Without PIS or Demat

What Is SOA Mode?

SOA (Statement of Account) mode means mutual fund units are held directly with the AMC or registrar, without a Demat account.

Why SOA Mode Works Well for NRIs

No PIS required

No Demat account required

No RBI reporting

Lower operational friction

Simpler taxation and repatriation

Clean ownership records

SOA mode is regulator-approved and widely used for NRI mutual fund investing.

Banking + Investing Decision Flow

Taxation Overview for NRIs

Bank Interest

NRE interest: Tax-free

FCNR interest: Tax-free

NRO interest: Taxable with TDS

Investments

Mutual funds: TDS applies at source

Direct equity: Capital gains tax applies

Tax treaties may offer relief based on country of residence

Summary: Best-Practice Structure for Most NRIs

Banking: NRE + NRO (and FCNR where relevant)

Investing: Mutual funds via SOA mode

PIS: Only if direct equity exposure is required

This setup minimizes tax friction and compliance risk.

FAQs

Is interest on FCNR accounts taxable in India?

No. Interest on FCNR deposits is tax-free for NRIs.

Can NRIs freely repatriate money from India?

Yes, from NRE and FCNR accounts. NRO repatriation is capped at USD 1 million per year.

Is PIS mandatory for NRIs?

PIS is mandatory only for direct equity investments in Indian listed shares.

Can NRIs invest in mutual funds without Demat?

Yes. Mutual funds can be held in SOA mode without Demat or PIS.

How many PIS accounts can an NRI have?

Only one active PIS account across all banks.

Does LRS apply to NRIs?

No. LRS applies only to resident Indians.

Final Takeaway

For NRIs, clean banking structure and the right investment mode matter more than product selection.

Using NRE and FCNR accounts appropriately, avoiding unnecessary PIS complexity, and investing via SOA mode creates a compliant, tax-efficient foundation for long-term wealth in India.