Article

Dec 27, 2025

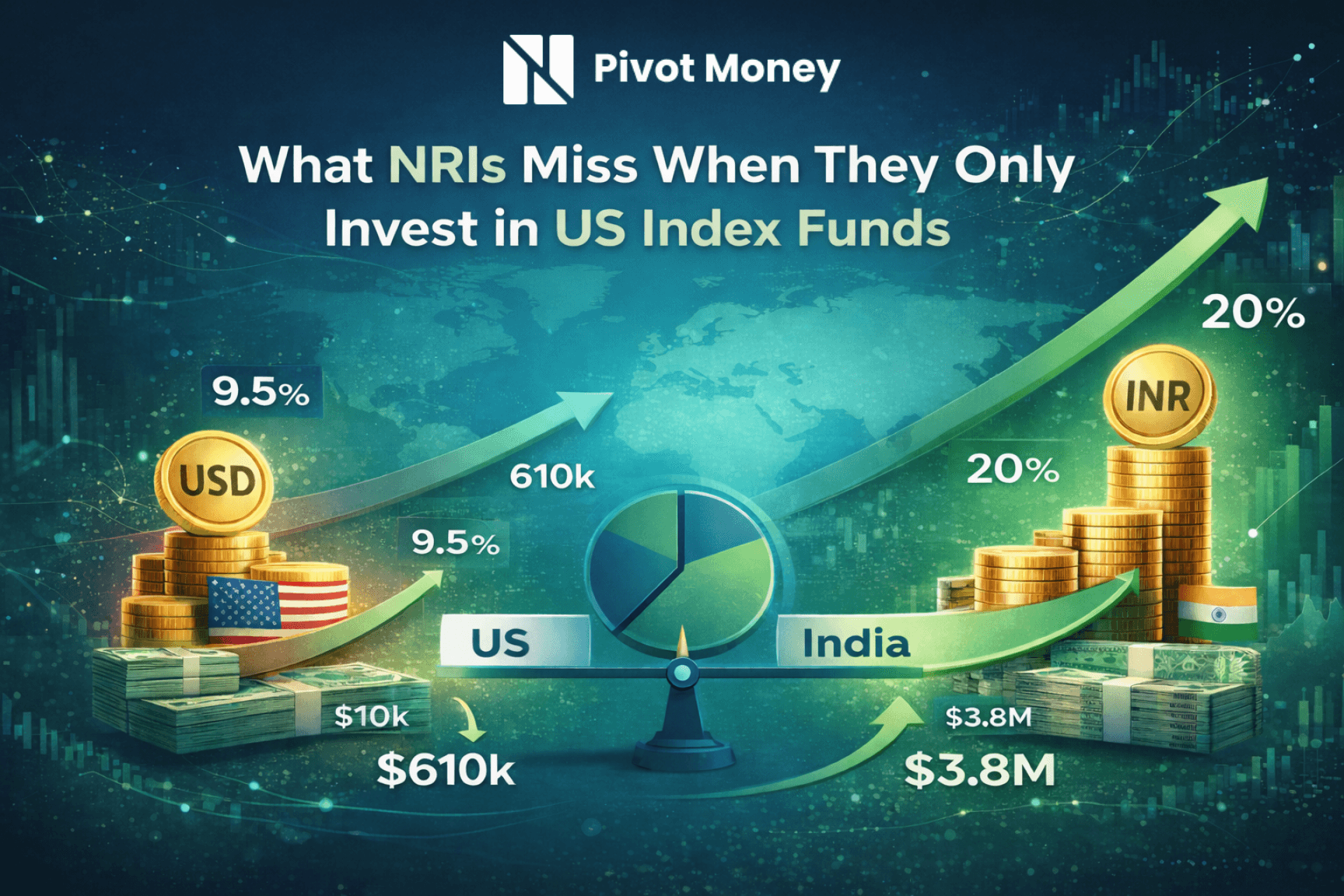

What NRIs Miss When They Only Invest in US Index Funds

Introduction

US index funds are a rational core for NRI portfolios. They are liquid, low-cost, and efficient. Over the last 20 years, the S&P 500 has delivered ~9–10% annualized returns in USD (S&P Dow Jones Indices). For stability and discipline, this works well.

What often gets missed is how different markets generate returns and where alpha still exists.

Efficiency limits upside

US markets are among the most efficient globally. Information is priced rapidly, governance standards are consistent, and competition for alpha is intense. This is precisely why passive ETFs dominate and why persistent outperformance is rare. According to SPIVA US, over 85–90% of active US equity funds underperform their benchmarks over 10–15 year periods.

India operates differently. Return dispersion across companies is higher, sector cycles are sharper, and balance-sheet quality varies more. This has allowed active Indian mutual funds to outperform more consistently, especially outside large caps (SPIVA India, MSCI India).

Index comparison shows the structural gap

Consider Nifty 500 TRI vs Russell 2000. Over long horizons, the Nifty 500 TRI has delivered ~13–14% CAGR, while the Russell 2000 has returned ~8% CAGR in USD (NSE India, FTSE Russell). The difference is not just growth, but structure. Indian active funds operating within the Nifty 500 universe have often beaten the index by managing leverage, governance risk, and cyclicality (AMFI, SPIVA India).

A simple example

An investor putting USD 100,000 into a US small-cap ETF growing at 9.5% ends up with roughly USD 610,000 over 20 years. The same amount invested in an India-focused small-cap equity mutual fund compounding at 20% grows to about USD 3.83 million (~6x increase), even before adjusting for partial currency impact. Over long horizons, the compounding gap dominates the FX headwind.

Concentration risk is rising in US indices

Diversification within US indices is narrowing. The top 10 stocks now account for ~35% of the S&P 500 (S&P Dow Jones Indices). Returns are increasingly driven by a small group of technology and AI-linked names, increasing regime and valuation risk for passive-only portfolios.

Currency is a portfolio input, not a veto

INR depreciation is real, averaging ~3–4% annually over long periods (RBI). Yet Indian equity returns have historically exceeded currency impact over multi-decade horizons (MSCI India). For NRIs with future INR-linked liabilities, zero exposure to India introduces a different kind of risk.

The portfolio implication

This is not about choosing India instead of the US. It is about structure.

US index funds optimize efficiency and stability

Indian mutual funds and equities add dispersion and long-term return optionality

Bottom line

US index funds are an excellent foundation.

But long-term wealth is built by combining efficient markets with markets that still reward selection.

For long-horizon NRIs, ignoring India is not conservative — it is incomplete.