India's Premier NRI Investment Platform

India's Premier NRI Investment Platform

Smart Indian Investing For NRIs & Global Indian Wealth

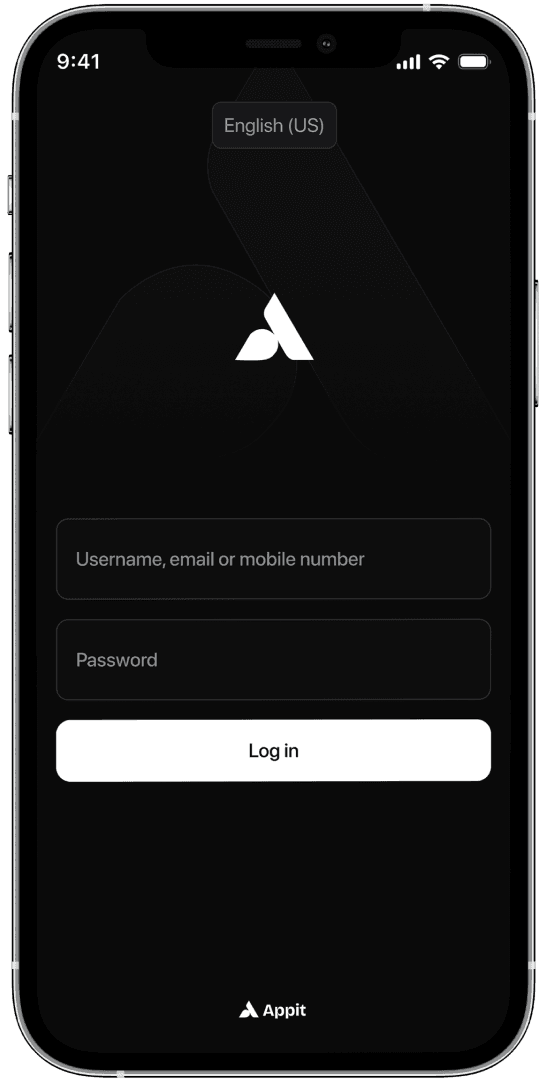

How It Works

Start investing in Indian mutual funds in 3 simple steps

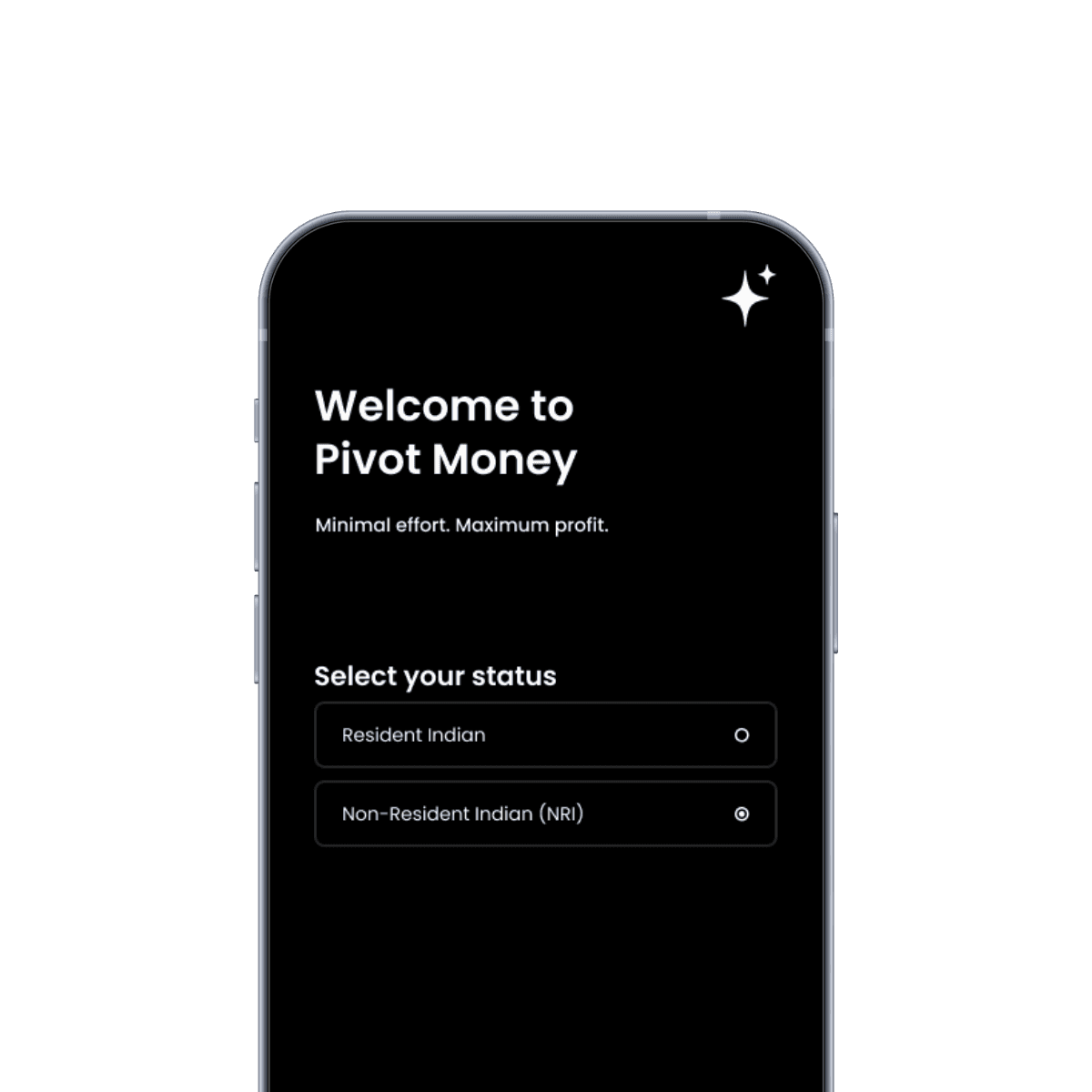

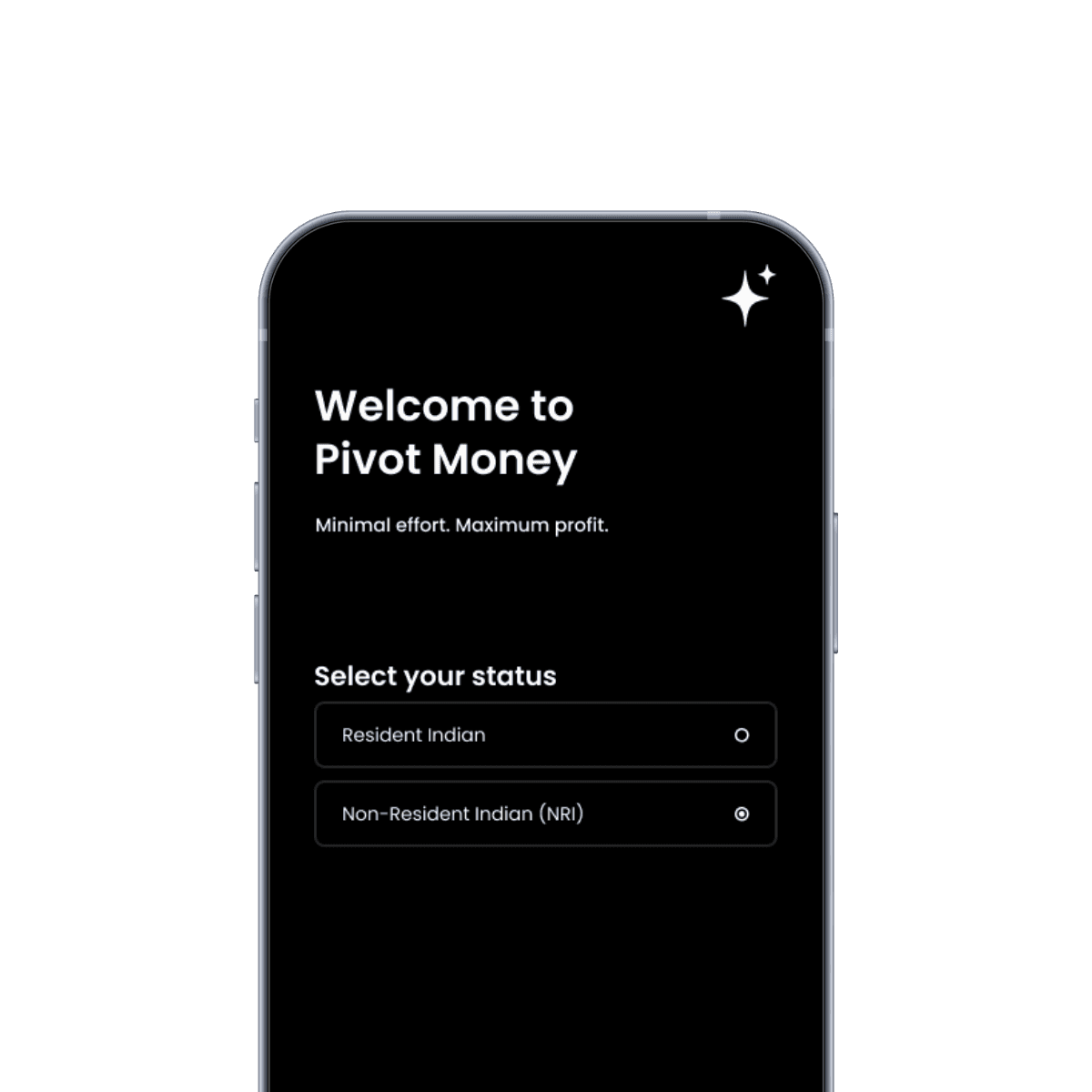

Step 1

Complete Digital Onboarding

Open your mutual fund account online from anywhere in the world. PAN, KYC, FATCA, and bank verification — fully digital.

Step 1

Complete Digital Onboarding

Open your mutual fund account online from anywhere in the world. PAN, KYC, FATCA, and bank verification — fully digital.

Step 1

Complete Digital Onboarding

Open your mutual fund account online from anywhere in the world. PAN, KYC, FATCA, and bank verification — fully digital.

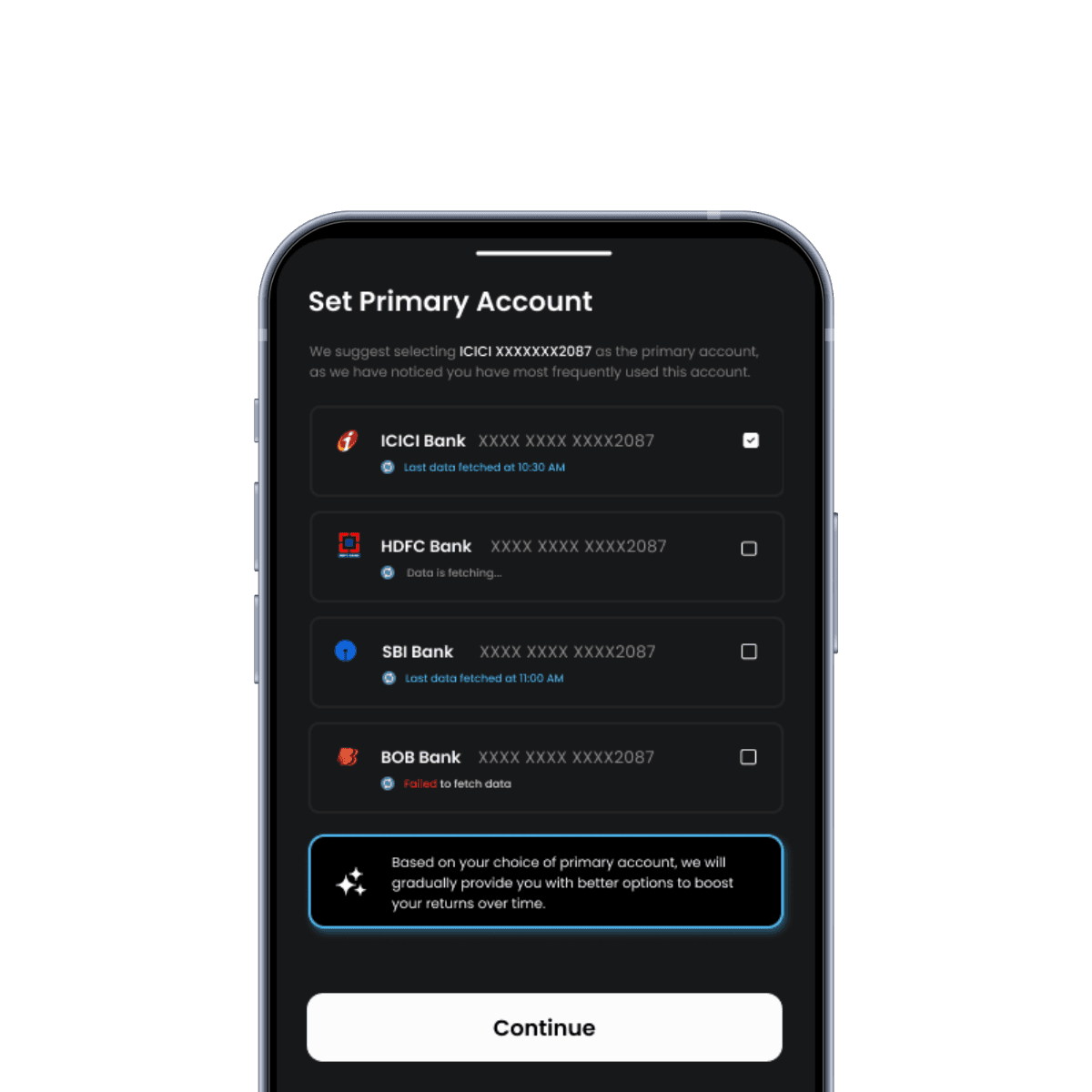

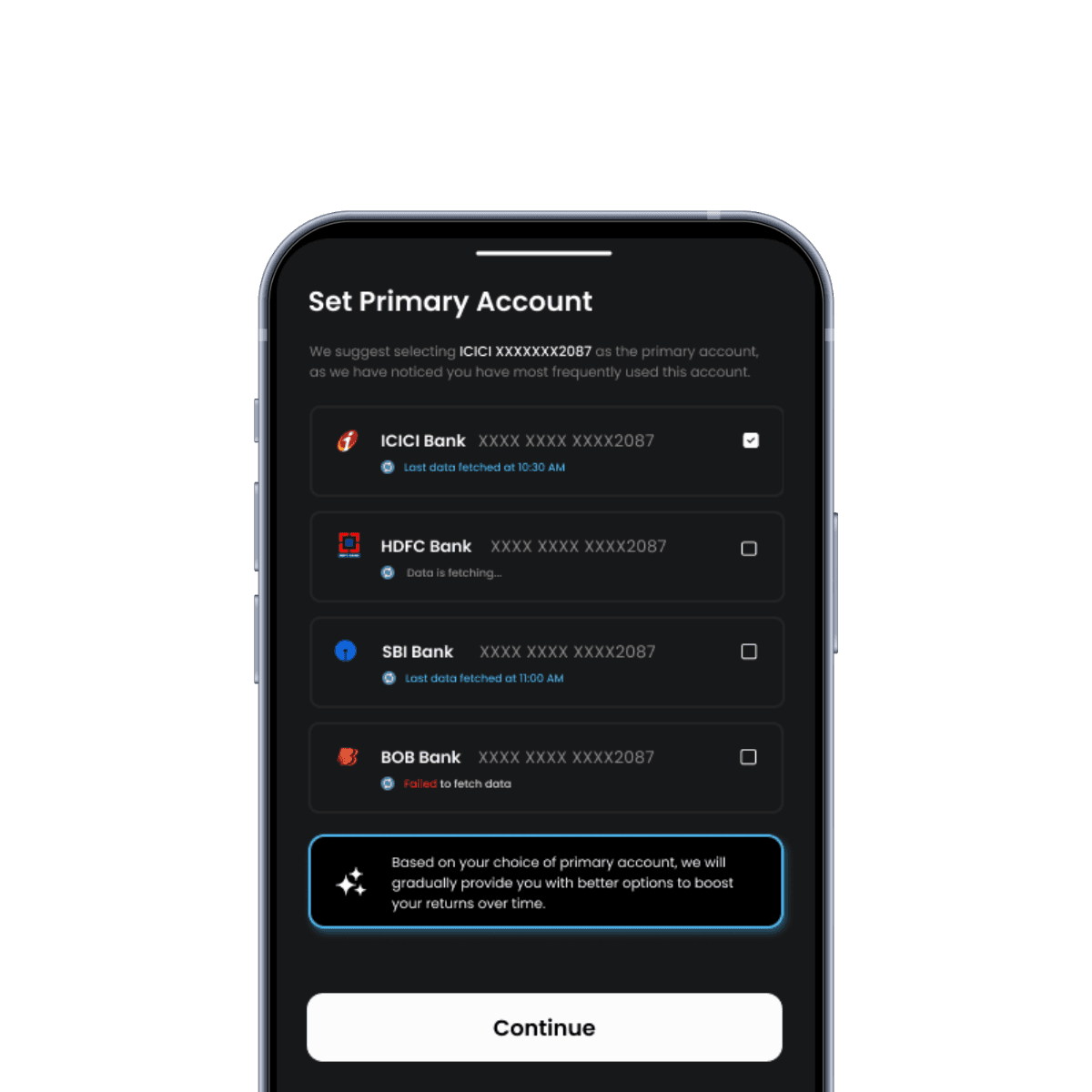

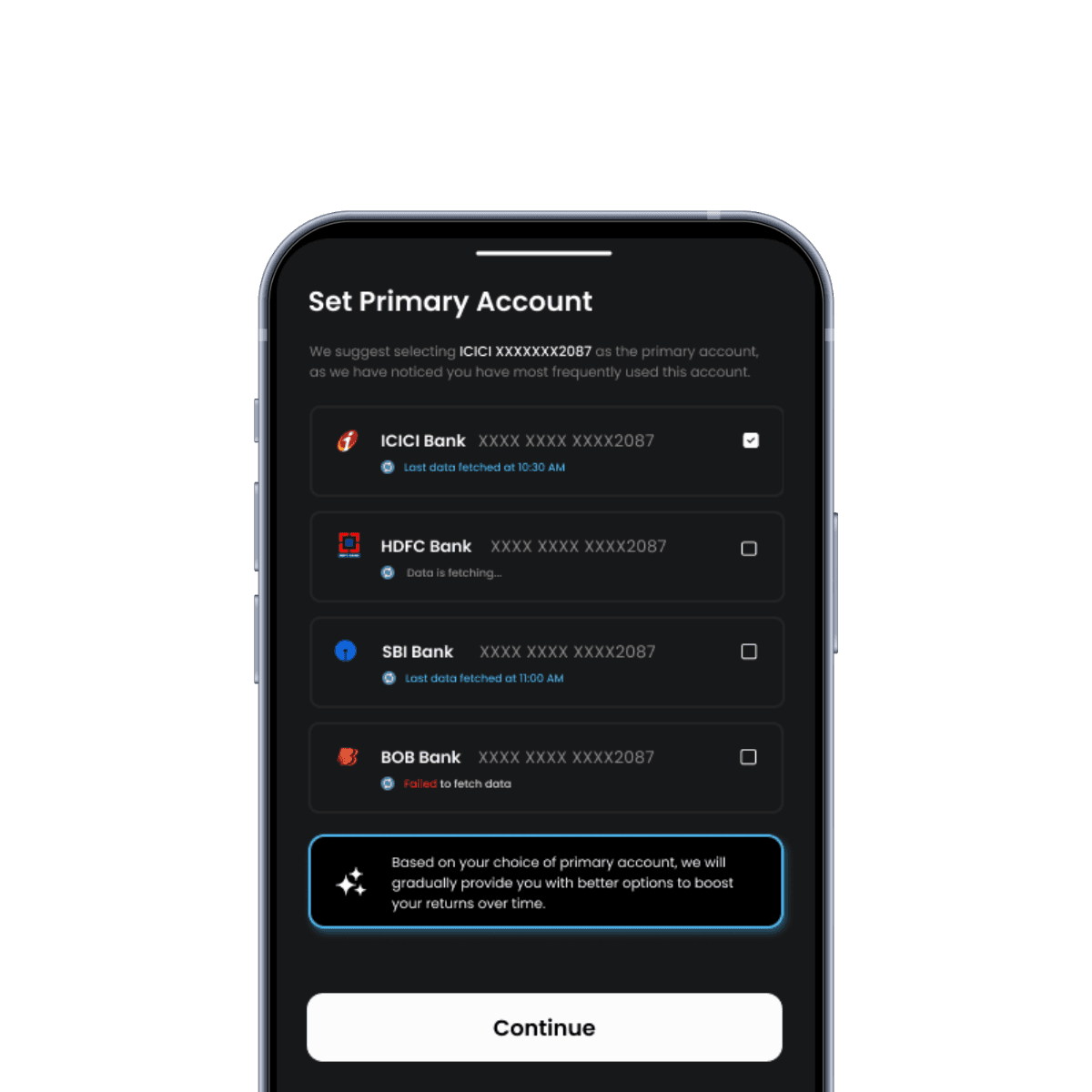

Step 2

Choose the Right Bank Account

Use NRE for foreign income with full repatriation, or NRO for Indian income with repatriation limits.

Step 2

Choose the Right Bank Account

Use NRE for foreign income with full repatriation, or NRO for Indian income with repatriation limits.

Step 2

Choose the Right Bank Account

Use NRE for foreign income with full repatriation, or NRO for Indian income with repatriation limits.

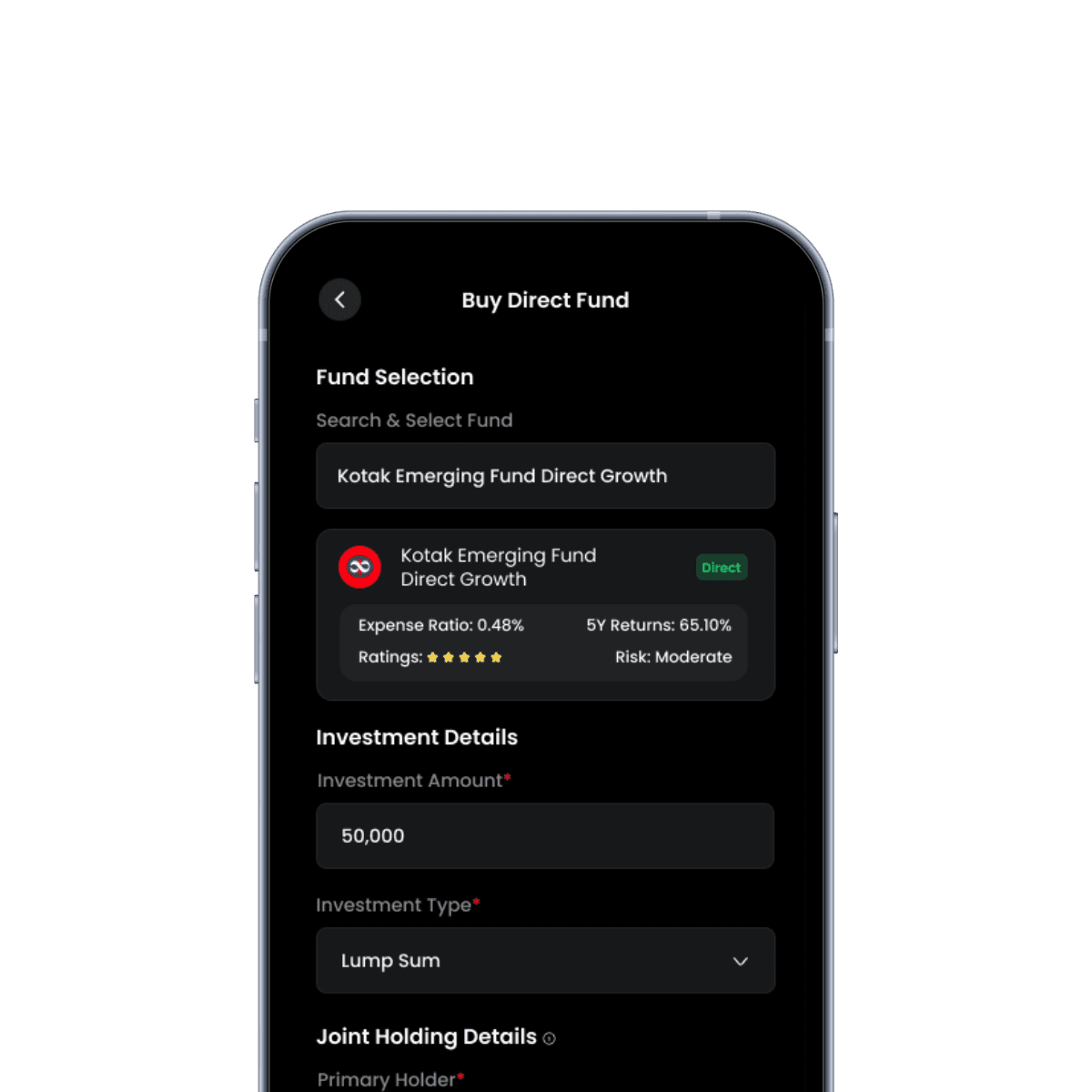

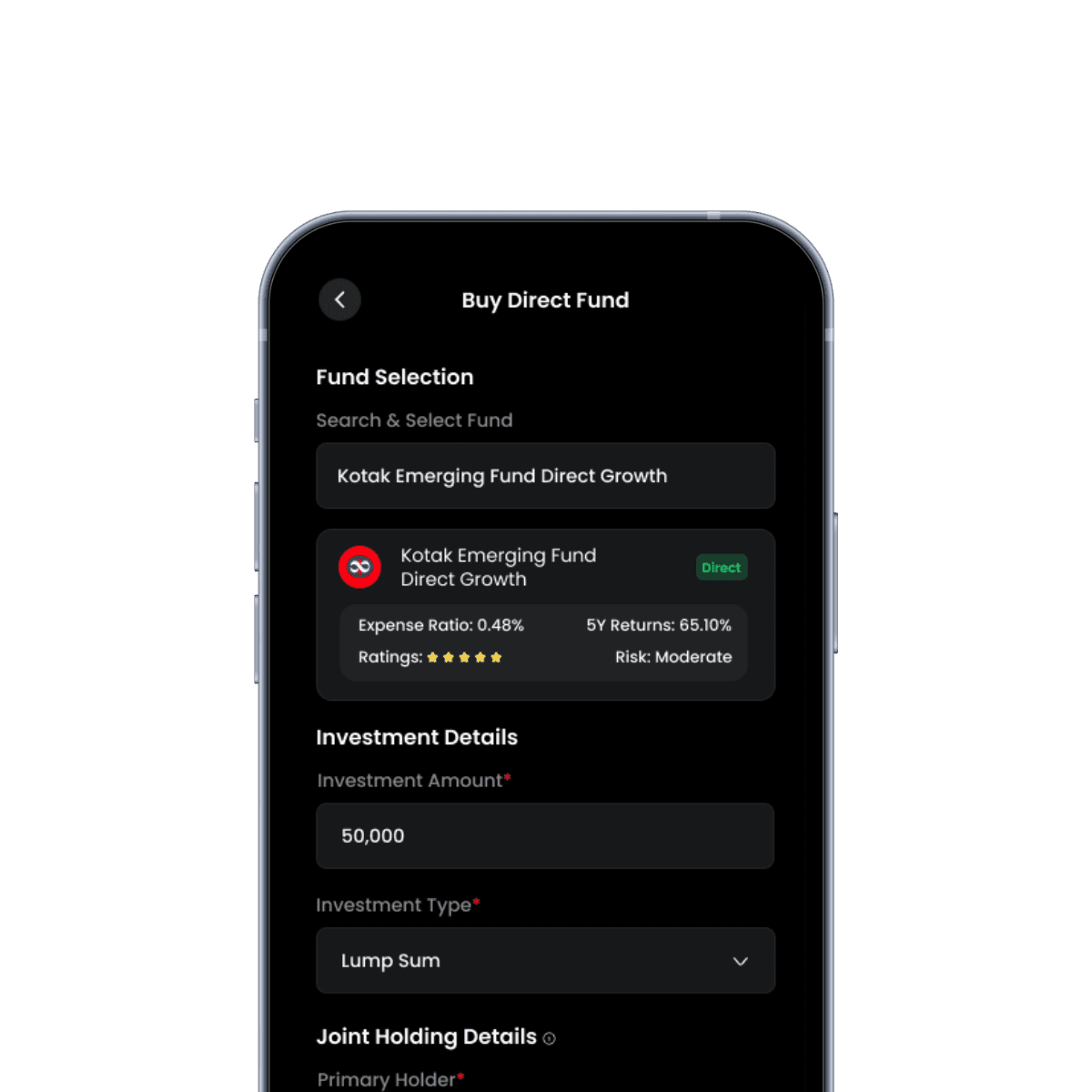

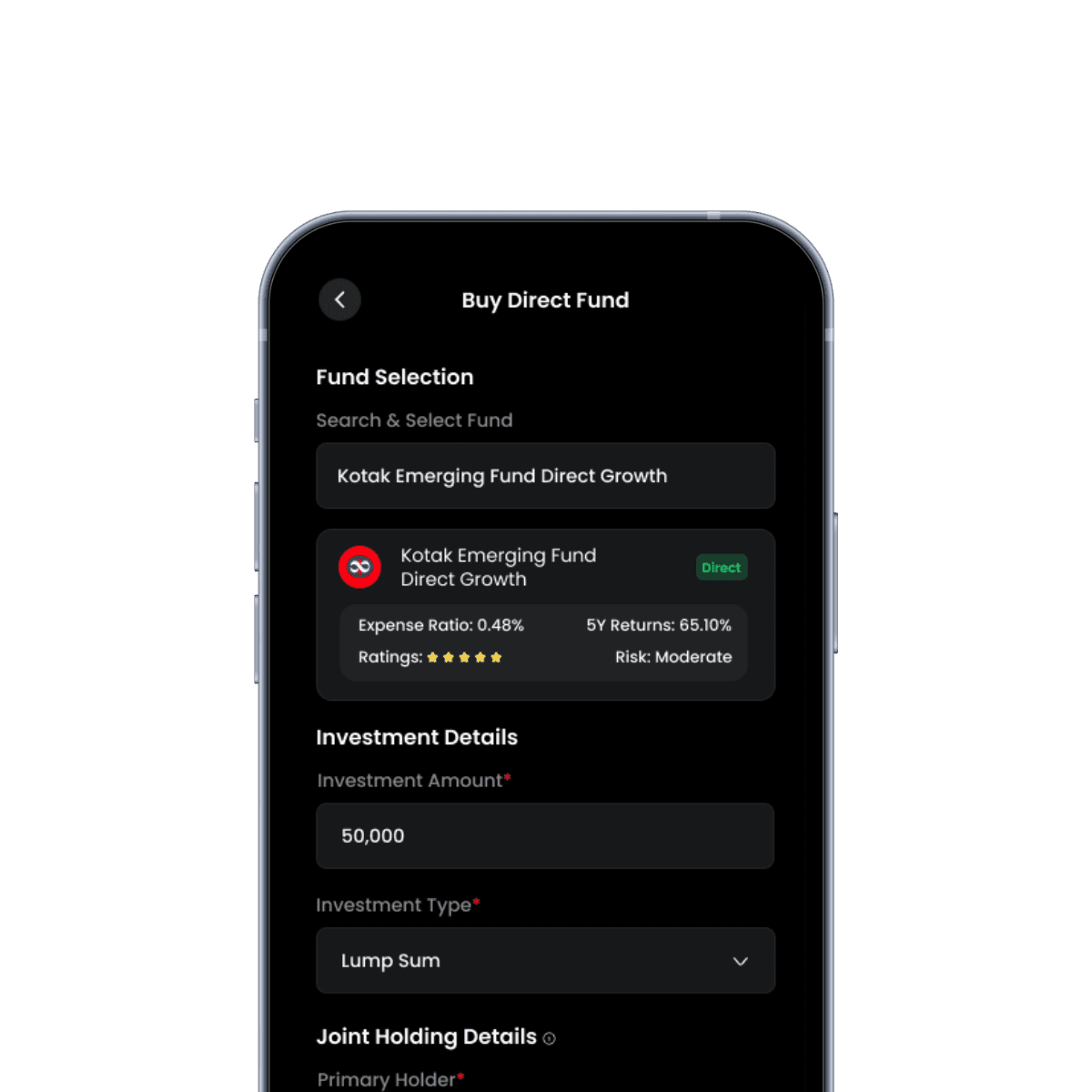

Step 3

Invest in Mutual Funds

Use your INR balance to invest. No FX conversion during purchase. No money ever comes to Pivot Money.

Step 3

Invest in Mutual Funds

Use your INR balance to invest. No FX conversion during purchase. No money ever comes to Pivot Money.

Step 3

Invest in Mutual Funds

Use your INR balance to invest. No FX conversion during purchase. No money ever comes to Pivot Money.

Why Invest In India

Compelling reasons for NRIs to invest in Indian mutual funds

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

If you don't plan to repatriate, INR depreciation can add ~3% to effective long-term returns

Why Invest In India

Compelling reasons for NRIs to invest in Indian mutual funds

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

If you don't plan to repatriate, INR depreciation can add ~3% to effective long-term returns

Why Invest With Pivot Money

The most transparent and secure way for NRIs to invest in India

You Are the Custodian

Unlike platforms where the broker is the custodian, your mutual fund units are held directly with CDSL / NSDL in your name.

You Are the Custodian

Unlike platforms where the broker is the custodian, your mutual fund units are held directly with CDSL / NSDL in your name.

Zero Payment Risk

Payments are made through a secure payment gateway. Funds move directly from your bank to AMC — never to Pivot Money.

Zero Payment Risk

Payments are made through a secure payment gateway. Funds move directly from your bank to AMC — never to Pivot Money.

Better FX Transparency

You use remittance apps with superior FX rates instead of bank-controlled conversions. Higher INR received = more units bought.

Better FX Transparency

You use remittance apps with superior FX rates instead of bank-controlled conversions. Higher INR received = more units bought.

No Hidden FX Charges

We never convert your money. You invest directly using INR already in your account.

No Hidden FX Charges

We never convert your money. You invest directly using INR already in your account.

Bank-Grade Security

We are Reserve Bank of India (RBI) and SEBI certified because your family's complete financial privacy is 𝗡𝗢𝗡 𝗡𝗘𝗚𝗢𝗧𝗜𝗔𝗕𝗟𝗘.

We ARE:

Financial Information User (FIU) compliant with Sahamati. RBI initative

Financial Information User (FIU) compliant with Sahamati. RBI initative

SEBI registered investment advisor

SEBI registered investment advisor

Digital Personal Data Protection Act Compliant

Digital Personal Data Protection Act Compliant

ISO Certified

ISO Certified

We will NOT:

Store your sensitive data, passwords and account details

Store your sensitive data, passwords and account details

Provide third party access to your data

Provide third party access to your data

Share your data

Share your data

Sell your data

Sell your data

Testimonials

Kaushik ⭐⭐⭐⭐⭐

My experience has been great with Pivot money so far, I was able to link my MF investments easily, understand my fund performance, got brilliant insights. Really helpful app.

Nirav Shah ⭐⭐⭐⭐⭐

Discovered Pivot Money via ChatGPT and honestly didn't expect much, but the app surpassed my expectations! Love how it pulls together all my bank and investment info automatically. Still hoping for better support for smaller banks and a more detailed gain analysis, but it's definitely one of the best financial trackers I've tried.

Ritesh Sunil Doshi ⭐⭐⭐⭐⭐

Best app to track your net worth. You get all your bank bal, investments in shares and mutual funds, insurance in one place. Kudos to developers for launching this app. Area for improvement is to link bank accounts with joint holders.

Dimpy Gandhi ⭐⭐⭐⭐⭐

Really useful app Love it! All my investments and bank balance in one screen. Super easy to check my net worth now. Was worried about security at first but they have bank level protection so it's safe. Saves me so much time.

Testimonials

Trusted by and Build for NRIs

Crores Saved

Pivot Money helps you invest in India hassel free

Trusted by and Build for NRIs

Crores Saved

Pivot Money helps you invest in India hassel free

"Really useful app Love it! All my investments and bank balance in one screen. Super easy to check my net worth now. Was worried about security at first but they have bank level protection so it's safe. Saves me so much time."Dimpy Gandhi

"Really useful app Love it! All my investments and bank balance in one screen. Super easy to check my net worth now. Was worried about security at first but they have bank level protection so it's safe. Saves me so much time."Dimpy Gandhi "Discovered Pivot Money via ChatGPT and honestly didn't expect much, but the app surpassed my expectations! Love how it pulls together all my bank and investment info automatically. It's definitely one of the best financial trackers I've tried."Nirav Shah

"Discovered Pivot Money via ChatGPT and honestly didn't expect much, but the app surpassed my expectations! Love how it pulls together all my bank and investment info automatically. It's definitely one of the best financial trackers I've tried."Nirav Shah "My experience has been great with Pivot money so far, I was able to link my MF investments easily, understand my fund performance, got brilliant insights. Really helpful app."Kaushik

"My experience has been great with Pivot money so far, I was able to link my MF investments easily, understand my fund performance, got brilliant insights. Really helpful app."KaushikWhy Invest In India

Compelling reasons for NRIs to invest in Indian mutual funds

Fastest Growing Economy

India is one of the fastest-growing major economies with strong GDP growth projections.

Higher Return Dispersion

Equity mutual funds in India offer higher return dispersion than developed markets.

Strong SIP Inflows

Strong domestic SIP inflows provide market stability and consistent growth patterns.

FX Advantage

INR depreciation increases investible value when sending money from abroad.

Natural Diversification

Invest in INR assets while earning in foreign currency — natural portfolio diversification.

No TCS on Inward Remittances

Tax Collected at Source doesn't apply to inward remittances, maximizing your investment.

If you don't plan to repatriate, INR depreciation can add ~3% to effective long-term returns

FAQs

Everything you need to know about investing in India as an NRI

Who holds my mutual fund units?

Can I repatriate my money anytime?

Is there any FX markup?

Is TCS (Tax Collected at Source) applicable?

Can I invest from the US, Canada, or UAE?

Who holds my mutual fund units?

Can I repatriate my money anytime?

Is there any FX markup?

Is TCS (Tax Collected at Source) applicable?

Can I invest from the US, Canada, or UAE?

Ready to grow your Indian wealth?

Get Indian Returns Wherever You Are

Join hundreds of NRIs already simplifying their Indian investments. Start today with zero hassle.

RBI, SEBI and DPDPA compliant

RBI, SEBI and DPDPA compliant

Bank-Grade Security

We are Reserve Bank of India (RBI) and SEBI certified because your family's complete financial privacy is 𝗡𝗢𝗡 𝗡𝗘𝗚𝗢𝗧𝗜𝗔𝗕𝗟𝗘.

We ARE:

Financial Information User (FIU) compliant with Sahamati. RBI initative

SEBI registered investment advisor

Digital Personal Data Protection Act Compliant

ISO Certified

We will NOT:

Store your sensitive data, passwords and account details

Provide third party access to your data

Share your data

Sell your data

We ARE:

Financial Information User (FIU) compliant with Sahamati. RBI initative

Financial Information User (FIU) compliant with Sahamati. RBI initative

SEBI registered investment advisor

SEBI registered investment advisor

Digital Personal Data Protection Act Compliant

Digital Personal Data Protection Act Compliant

ISO Certified

ISO Certified

We will NOT:

Store your sensitive data, passwords and account details

Store your sensitive data, passwords and account details

Provide third party access to your data

Provide third party access to your data

Share your data

Share your data

Sell your data

Sell your data